CRIF Gulf's (D&B) Trade Payment Program helps risk management to improve collections and productivity while supporting the quality of information available to help other business decision-makers reduce credit risk.

WHY USE PAYMENT DATA?

- One of the most crucial criteria for determining when and if a company is likely to fail is their past payment performance.

- 90% of bankrupt companies exhibited delayed, fluctuating or below industry average payment behaviours.

- CRIF Gulf (D&B) collect trade experiences, combine them with information from a wealth of data sources to complete the true image of a business’s financial stability – past, present and future.

- Trade is considered to be the most important predictive indicator in our DUNS Right Data Quality Process – allowing us to be confident that every credit decision you make is based on all the relevant data available

No other company has a database with the depth and breadth of global payment data that CRIF possesses. This payment data is a critical component of our ratings and scores to predict payment behaviour and risk of failure Without this information you would not be warned of the signals that precede a company failing. This could mean a decrease in cash flow and eventually an increase in bad debt for your company without this payment data.

Participation and access to reports is free of charge

Your customer data is secure at all times

Your company's name is kept confidential at all reporting levels

SO WHAT COULD YOU DO TO AVOID THIS?

Join our Trade Partner Program !

On a monthly basis each Trade Partner provides their ledger to CRIF Gulf (D&B) – this information is then fed into the CRIF Gulf (D&B) Database so that we can see the latest payment habits of their customers. In return for this data the Trade Partner receives free of charge data that focuses on reducing DSO and risk. This service is FREE of charge based on an exchange of data. All trade partners supply payment data on a monthly basis to CRIF Gulf (D&B) in return for access to their own secure web area, monitoring the payment behaviours of their customer base.

Trade web incentive enables you to:

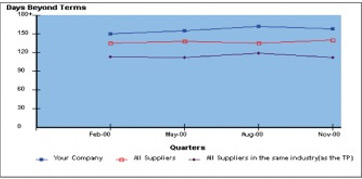

- Find out how fast your customers pay you compared to how fast they pay other suppliers and how they pay suppliers in the same industry as you.

- Identify specific customers whose payment performance is poor and where action is required.

- Look up the payment performance of specific industries.

Help the business community and yourself:

By sending CRIF Gulf (D&B) your payment information, favourable and unfavourable experiences are available to the credit industry, which provides a more accurate and balanced portrayal of the customers’ payment habits.

- Discover the important characteristics of your whole customer base - what do your best customers look like in terms of payment record, company size, company age and industry type.

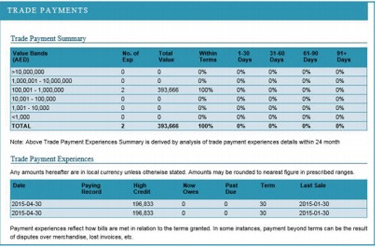

- Analysis by Customer - shows whether your customers pay you more slowly than the other companies on the CRIF Gulf (D&B) database. Analysis by Customer also allows you to pinpoint the customers who are not paying you as quickly as other suppliers. You can then link to the most recent D&B Finance reports at the click of the mouse.

- Industry Analysis - if you want to check how a particular industry pays suppliers.

- Portfolio Analysis - something your colleagues in Marketing should also find useful. Find out more about your customers - which industries, age and size of companies provide your biggest sales. Each partner’s involvement is totally confidential. Assurance in the form of a confidentiality agreement is available on request.

For more information contact Ivan Pereira by e-mail at [email protected] or phone at +971 4 406 9912

VALUE ADDED RISK SOLUTIONS

To help you easily make sense of, benefit from and track all this data in the way that best suits your needs, we also provide an extensive portfolio of value added risk management solutions including:

GULF DWC LLC operates

GULF DWC LLC operates  in the U.A.E territory.

in the U.A.E territory.