First of two articles on how data and analytics let you achieve multi-tier visibility into your supply chain

When you think about it, you would be hard-pressed to find a data-inspired creation of the digital age with more impact than GPS. Along with saving marriages from the strain of asking for directions and finding takeout options for the hungry kids whining in the back seat, it helps farmers maximize their land, 911 responders reach those in need, shippers deliver supplies and civil engineers lay out thoroughfares.

You might ask, with tongue firmly planted in cheek, “Where would we be without GPS?”

For Chief Procurement Officers, though, you need to map more than just your fastest route to the airport. You need to see around every corner to coordinate your increasingly complex global supply chain with accurate data and advanced analytics.

Suppliers are among the most important relationships a company has. In this two-part series, we explore how to manage those relationships more successfully than ever. Here in Part 1, we explore a data-inspired approach to mapping your suppliers. In part 2, we look at a case study of how a global aerospace giant delivered on that promise.

Supply Chains Exposed to a Wide Range of Threats

In today’s global economy, supply chains have become significantly longer and more complex, exposing them to greater risk than ever before. While Tsunamis, plant explosions, and other catastrophic events may grab the headlines, the ongoing, risks associated with a company’s day-to-day operations can be just as damaging.

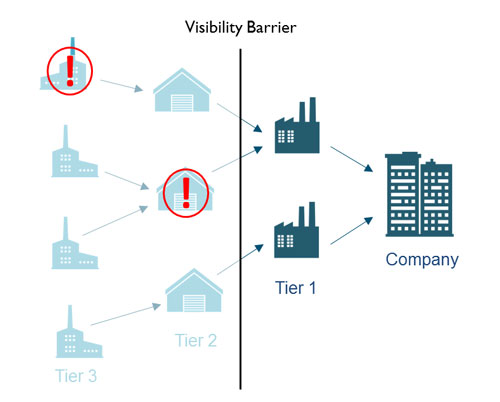

Such threats can emerge from any corner of the globe at any time and include everything from financial instability of suppliers, country and geography risk, lack of supplier diversification, poor quality, non-compliance with government regulations, failures in corporate social responsibility, and many others. They are also not limited to just a company’s Tier 1 suppliers. Rather, their sub-tier suppliers (Tier 2 through Tier-N) have the potential to be just as disruptive to a company’s business.

If you’ve experienced a supply chain disruption, you’re not alone. According to the Business Continuity Institute, 85% of all companies have at least one disruption each year. As companies extend their supply chains deeper into emerging markets in search of lower costs, the frequency of these disruptions will only increase.

Disruptions Damaging on Multiple Levels

When supply chain disruptions do occur, they can be damaging on many levels, harming financial performance, tarnishing the brand image, and destroying shareholder value.

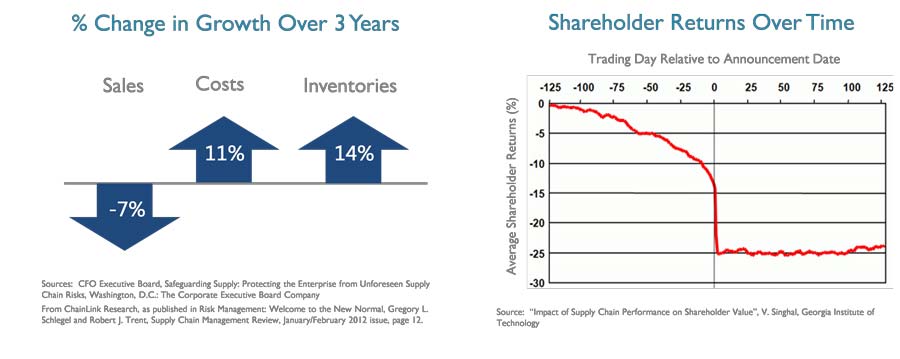

The impact can be quite severe and have a lasting effect on key performance metrics, like sales, costs, inventories, and stock price.

A study from the CFO Executive Board examined the long-term effects on corporate performance of significant supply chain disruptions. The study covered 800 supply chain disruptions experienced by publicly traded firms.

Over a three-year period, sales growth for the affected companies dropped 7% while costs rose on average 11% and inventories ballooned 14%. Negative returns for shareholders were even more stark, with an average 25% drop in stock price that, in some cases, took years to fully recover.

The Need for Supply Chain Visibility

Why do supply chain disruptions occur and what can be done to prevent them? Let’s start with the first question, why disruptions occur.

The answer: Poor visibility.

Poor visibility makes it impossible for companies to fully understand the nature and level of the risks they face through their suppliers. Without this knowledge, they can’t develop an effective risk mitigation strategy.

According to KPMG, 54% of CPOs admit that their firms don’t have visibility beyond their direct (Tier 1) suppliers. However, the majority of disruptions originate with sub-tier suppliers (the suppliers of their suppliers), according to a study from Allianz Insurance.

It’s no wonder why breaking through this “visibility barrier” to gain insights into the supply chain is a top priority for most companies today.

Why the Traditional Approach Fails

So what can be done to increase visibility into the supply chain?

A common approach is to survey suppliers. This involves reaching out to each supplier and requesting information on their suppliers and so forth down the chain. Unfortunately, there are several shortcomings to this approach:

It’s a one-time exercise

Supplier response rates are often extremely low – often in the single digits

Because it’s labor-based, it’s costly and doesn’t scale efficiently

It takes a long time – projects often run 9 months to over a year

To make matters worse, because the supply base is constantly changing (e.g., suppliers acquire and divest other companies, new products are added or removed, manufacturing sites are opened and closed, and so on), by the time the surveying is completed, much of the information is already obsolete.

The result: Hidden risks remain largely undetected and developing a well-informed risk mitigation strategy becomes extremely difficult.

Analytics: Enabling Next-Level Supply Chain Visibility

At Dun & Bradstreet, we’ve developed a unique, analytics-based approach to overcome the inherent shortcomings of traditional supplier surveying. By combining our supplier database and other proprietary information with the power of advanced analytics, we’re able to help companies gain visibility into their supply chains quickly, efficiently and repeatedly – typically within a few of weeks.

Our approach is based on 3 critical components:

- Automation to produce an accurate, timely view of the supply chain

- Predictive analytics to anticipate the nature, location, and timing of the risk

- Scoring to understand the magnitude of risk and to help prioritize efforts

This can deliver ongoing, actionable insights that are critical for developing an informed strategy to mitigate supply chain risk and gain competitive advantage. With these types of new insights, companies can:

- Ensure supplier diversification. Do I have a supplier in Tier 2 that multiple Tier 1 suppliers are buying from, creating a false sense of diversification (i.e., single point of failure)?

- Identify hidden risky patterns. Do I have multiple suppliers of critical components concentrated in the same risky geography (e.g. flood zone along coast of Indonesia)? Do I have significant compliance exposure (e.g. conflict minerals, bribery, anti-money laundering)? Do I have reputational risk (e.g. sustainability, diversity, counterfeit parts, child labor)?

- Negotiate better agreements. Do I understand the cost drivers for Tier 1 suppliers, based on the nature of the supplier’s industry and its own suppliers (e.g., the supplier is in a capital intensive business where receiving quicker payments may be valuable)?

- Predict Tier 1 supplier performance. Do I know which Tier 1 suppliers will have performance issues (e.g., defective parts, late deliveries) and the best ways to prevent them from occurring?

What might that mean for your company’s supply chain? Our companion article to this one, publishing soon, will go into detail on how the approach provided sky-high insights for an aerospace giant. So come back for more!